`

Why NuVu Advisory?

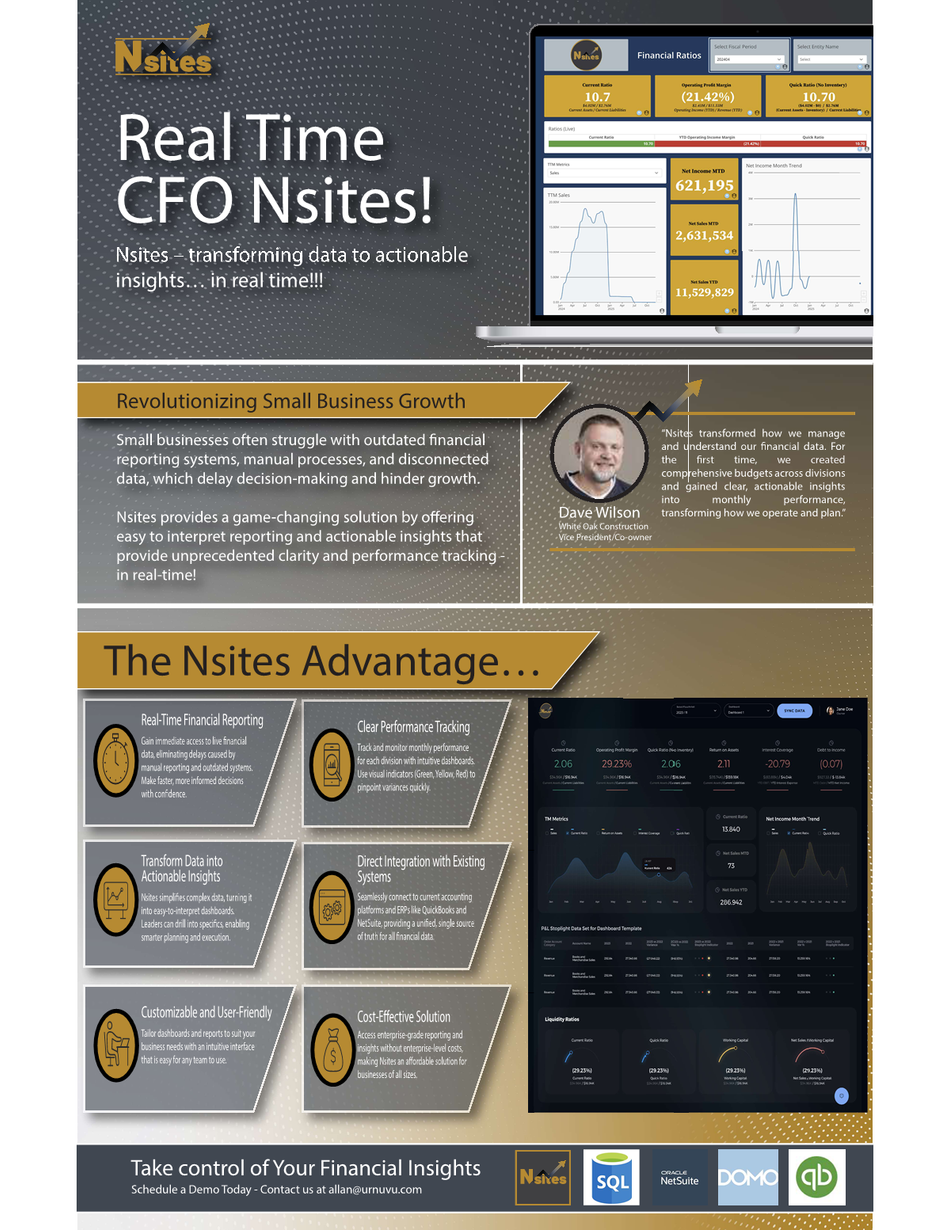

Our difference hinges on our nearly 30 years of experience across corporate finance and manufacturing operations which leverage lean and six sigma principles. These experiences, coupled with our approach to processing data into meaningful information, allow us to provide useful insights to our clients quickly by leveraging our proprietary Nsites application.

Our 30 plus years of service includes work in automotive, aerospace, pharmaceutical, manufacturing and service businesses. We have experience in both Finance and Operations which gives us the unique ability to not only understand the story behind the numbers, but the ability to determine and implement corrective actions that maximize efficiencies and reduce cost which will help maximize profit and shareholder value.

Our services include:

- CFO Advisory Services

- Budget Development & Management

- Financial Planning & Analysis

- KPI & Dashboard Development

- Financial Statement Preparation and Automation

- Profit & Shareholder Maximization

- Data Transformation

NuVu Advisory: Elevate Your Financial Perspective

CFO Advisory Services

Corporate CFO advisory services refer to strategic consulting and guidance provided by financial experts to a Chief Financial Officer (CFO) or finance team within a company. These services involve offering insights, recommendations, and solutions to address complex financial challenges, optimize financial processes, and enhance overall financial performance. CFO advisory services may cover areas such as financial planning, risk management, mergers and acquisitions, capital structure optimization, and compliance with regulatory requirements. The goal is to support the CFO in making well-informed decisions that contribute to the company's financial health and long-term success.

Budget Development & Management

Budget management refers to the process of planning, allocating, and controlling financial resources within a company. It involves creating a comprehensive budget that outlines projected revenues and expenses, and then monitoring and adjusting financial activities to ensure adherence to the budgetary constraints set by the organization. Effective corporate budget management is crucial for financial stability, strategic planning, and achieving business goals.

Financial Planning & Analysis

Financial Planning and Analysis (FP&A) is a strategic function within a company that involves forecasting, budgeting, and analyzing financial data to support decision-making. It encompasses activities such as creating financial models, evaluating performance against financial goals, providing insights into future financial trends, and assisting in strategic planning. The goal of FP&A is to help organizations make informed financial decisions, optimize resource allocation, and achieve their financial objectives.

Key Performance Indicator (KPI) & Dashboard Development

Key Performance Indicator (KPI) and dashboard development involve the identification, selection, and presentation of key metrics that are crucial for monitoring and evaluating the performance of a company.

Key Performance Indicators (KPIs): These are specific, measurable metrics that reflect the critical aspects of an organization's performance in line with its objectives. KPIs can cover various areas such as financial performance, customer satisfaction, operational efficiency, and employee productivity. KPI development involves identifying and defining the key metrics that are critical for assessing the performance and success of a company. This process includes selecting specific indicators that align with the organization's strategic objectives and can effectively measure progress towards those goals. Corporate KPI development aims to provide a set of quantifiable and measurable metrics that facilitate informed decision-making, performance evaluation, and the overall assessment of the company's health and success.

Dashboard Development: A dashboard is a visual representation or interface that displays a set of KPIs and other relevant data in a consolidated and easily understandable format. It provides a real-time snapshot of the company's performance and helps stakeholders make informed decisions.

Together, KPI and dashboard development play a pivotal role in strategic management, allowing businesses to track progress, identify trends, and align their activities with organizational goals.

Financial Statement Preparation and Automation

Financial statement automation and preparation involve leveraging technology to streamline and optimize the process of generating financial statements for a company. This includes automating the collection and processing of financial data, performing calculations, and generating standardized reports such as income statements, balance sheets, and cash flow statements. The use of specialized software and tools in this context aims to improve accuracy, efficiency, and timeliness in financial reporting. By automating these tasks, organizations can streamline and expedite the processes of generating financials statements and also reduce manual errors, save time, and ensure compliance with accounting standards. The aim is to improve efficiency, accuracy, and reduce the manual effort associated with financial reporting. Automated systems help ensure compliance with accounting standards and provide timely and reliable financial information for decision-making.

Profit & Shareholder Maximization

Profit & Shareholder maximization is the objective of a company to achieve the highest possible level of profit within its operations. This goal involves optimizing revenue generation while minimizing costs and expenses. While profit maximization is a traditional goal in economic theory, companies often balance this objective with other considerations such as long-term sustainability, ethical practices, and maintaining positive relationships with stakeholders. Achieving corporate profit & shareholder maximization involves strategic decision-making, efficient resource allocation, and effective management of various factors impacting the financial performance of the business.

Data Transformation

Transitioning data to information involves the process of converting raw data into meaningful and useful insights. While data consists of facts, figures, and observations, information is the result of organizing, analyzing, and interpreting that data to provide context, relevance, and value. This transformation often includes data processing, pattern recognition, and the extraction of meaningful conclusions. The goal is to turn data into actionable knowledge that can support decision-making and contribute to a better understanding of a given subject or situation.